This post was earlier cross-posted at Leonid Schneider's site, hence the unfrivolous tone. The version there is improved by Leonid's editing and frame story, and by his account of the bumptious, censorious legal threats arriving from MagnesGas / Taronis

The cast of characters from an earlier post included Prof. R. M. Santilli, a scientific maverick who seems to have escaped from an unwritten Tintin comic, bringing equal portions of delight and perplexity into the lives of anyone whom he isn't suing. Santilli enjoys some standing in the Exotic Fusion community with his far-reaching reports of advanced nucleosynthesis, achieved with homemade steam-punk appliances, and has been published in International Journal of Hydrogen Energy -- nominally a real journal, from Elsevier¹ -- not just in predatory journals, or ones he founded and edits personally. He could be the greatest scientist since Newton, whose brilliance is ignored by the scholarly establishment, or someone who has convinced other people with his fantasies, but either way he comes into the ambit of For Better Science. So welcome to the Santilliverse of alternative physics, magnecules, Nobel nominations, sockpuppets and litigious vexations.

I hope that neither party will be offended when I compare Santilli to Donald Trump in terms of self-satisfaction and of openness to beliefs and theories that lie outside the bounds of conventional thought. Santilli's openness to entire alternative realities includes a nomination pathway for Nobel Prizes (in physics and chemistry) that lies parallel to the pathways recognised by the Nobel committee themselves -- allowing him to be nominated (by proxies and sockpuppets) regularly since his first nomination in 1985.

Abject source reveals treasure

Regrettable EU research investments are another perennial concern here, and this post is also an excuse to look at the decision to grant €6 mill to a German start-up, Infinite Fuels gmbH, to develop technology for turning organic waste into synthetic fuels. The link is a chapter in the Santilli story in which he founded the US company 'MagneGas' to commercialise his discovery of 'hadronic chemistry' and 'magnecules' and 'magnecular bonds'. For IF bought a license to Santilli's technology, and its relationship to MagneGas may be closer than expected. It is not my intention, though, to work the stock-tips / Investment-Advice side of the street. We learn from alchemy that the greatest treasures are found in abject places, while weird dreams about snakes can inspire a chemistry breakthrough, so this post is not about the current financial state or long-term viability of either company: these do not depend on MagneGas' curious origins.The Whackyweedia 'Talk' page on Santilli is as good a place to start as any. Like all the best Talk pages, it is best read as literature. A small bemused cadre of Wiki moderators and referees struggle to keep order among the other voices, enforcing the Wikicriteria of notability and the hierarchies of evidence-sourcing, reversing the impassioned edits defending Santilli's claims while playing Whack-a-Mole with incursions of sockpuppets... if the page is a theatrical production inspired by Finnegans Wake, it is one of those bravura productions where 90% of the characters are voiced by a single actor.

Hitmouse with a Hating Book

Dutch chess-player and blogger Pepijn van Erp wrote of encountering some of these 'virtual personalities' who co-sign Santilli's papers or write in support of him. More broadly, van Erp's Santilli Archives are a valuable resource. You can read there about Santilli's law suit against van Erp, for he was written down in the annals of Santilli's Hating Book (along with the admin echelons of Whackyweedia) as fair game for denunciations. The suit was settled by assuaging Santilli with the title of "Florida Genius".

Dutch chess-player and blogger Pepijn van Erp wrote of encountering some of these 'virtual personalities' who co-sign Santilli's papers or write in support of him. More broadly, van Erp's Santilli Archives are a valuable resource. You can read there about Santilli's law suit against van Erp, for he was written down in the annals of Santilli's Hating Book (along with the admin echelons of Whackyweedia) as fair game for denunciations. The suit was settled by assuaging Santilli with the title of "Florida Genius".Van Erp also blogged about Santilli's commercial side-line in 'reverse telescopes' for viewing antimatter galaxies and antimatter alien spaceships. The underlying principle is that antiparticles and antimatter do not emit photons, but rather anti-waves of antiphotons, which accelerate faster than light when passing through a dense medium like glass; thus they require telescopes with reversed optics to render them visible.

Anticandle emitting antiphotons

Don't bother asking where reflector telescopes fit into the picture, for this is bonkers. It is contrary to every observation of antimatter behaviour, and one cannot fathom the cognitive processes from which the concept emerged. More to the point, Santilli sold his antitelescopes through the website of Thunder Energies -- a listed corporation with the ticker symbol TNRG, originally founded as Thunder Fusion Corporation with super-energy synthetic gas as its core activity. We'll come back to that.

Santilli later sold Thunder Energies to a leisure group in need of a shell company. It is now trading as 'Nature Consulting', an on-line boutique for THC and concierge hash oil, at least maintaining the green theme.

Back in the 1980s, Santilli impressed Karl Popper as being a quantum theoretician with a correct philosophical outlook. He must have also convinced the right people that he spoke fluent Quantum, and was rewarded with temporary research fellowships at MIT and Harvard. Others at Harvard like Glashow and Weinberg were evidently not so besotted with Santilli's Hadronic Mechanics, failing to recognise the brilliance of Isodual Mathematics, earning themselves their own entry in the Hating Book. The resulting embittered grudge has lasted the rest of Santilli's life.

Santilli's mathematical innovations allowed him to bring back many insights from forays into alternative realities. Perhaps the greatest is 'magnecular bonds", which form when an intense magnetic field (e.g. from an submerged electric arc) polarises the electron states in adjacent orbitals and aligns them into coherence. An entire esoteric meta-chemistry is devoted to 'magnecules' where atoms are held together by magnecular bonds as well as or instead of the covalent bonds of mundane chemistry.

Magnecular bonds play a role in Santilli's New Alchemy accomplishments, transmuting lighter elements into nitrogen and silicon in garden-shed steampunk pressure-cookers (though this is not entirely clear, as some of his epigones ascribe the transmutation to 'neutroids').

What concerns us here, though, is the higher energy output when magnecules combust, as the esoteric bonds release the energy stored in them by the holy arc fire. A lesser, venal man would have pursued applications in high-energy super-explosives, and made a fortune, then we would hear about Santilli Prize medals,² awarded to Santilli Laureates each year amid glittering pageantry. Instead, Santilli focussed on the potential of Magnecules as a syngas for industrial / engineering cutting and welding, and founded the MagneGas Corporation (ticker symbol MNGA). The advantages of magnecular products over those dependent on mere covalent bonds include (1) the higher cutting temperature; (2) the greater density of magnecular gas, with the magnecular bonds condensing molecules into clusters; and (3) the green bonus of detoxifying industrial effluent, for biomass of any kind can serve as feedstock for the transforming, purifying fire of the underwater arc.

Later statements from the MagneGas Corp. blamed lack of waste-handling permission for their failure to detoxify any effluent, forcing them to make MagneGas from a careful mixture of vegetable oil and ethylene glycol.³ Bait, meet switch. By then, Prof. Santilli had handed over control of the company to his son Ermanno as CEO, with a board dominated by other family members. The Magnecule Magic largely disappeared from the company website, a proprietary combination of Venturi nozzle and arc replaced the submerged plasma, and the key selling point of 'MagneGas II' (chemically a blend of hydrogen and CO in 2011, and of hydrogen and nitrogen with traces of ethane and acetylene in 2014) was its lower energy density than alternatives like acetylene, and a lower burning temperature, therefore safety. The US Navy considered buying MagneGas but rated it as unfit for purpose, being more expensive and less useful than its commercial rivals. Excerpts from the Navy report feature in a lengthy Investment Advice column of the form I am not trying to write, along with an analysis of how the company recruits investors in the absence of a marketable product.

MNGA became TNRX in Feb 2019 when the company rebranded as Taronis Technologies, apparently taking the name from a Celtic god of thunder (in keeping with the 'Thunder Energies' tradition). Meanwhile Ermanno stepped sideways from the CEO position to Chief Technology Officer, while a Scott Mahoney -- the company's CFO from 2016 -- became the new CEO.

A boardroom coup followed soon after, with Ermanno

Attention now shifts to a new spin-off company with the same management, Taronis Fuels (TNRF) and its website, where most of the activity is. The old Taronis Tech website is static as of writing, and austere, and dominated by PDFs explaining (and as part of) the settlement of the 'San Diego lawsuit'. Also too, Taronis Tech has changed ticker again, from TNRX to BBHC, with the unintended effect that asset / debt transfers between parent and spin-off company could appear to naive onlookers like actual commercial transactions.

That settlement ensued from a false announcement that the city of San Diego had elected to adopt MagneGas technology, and from the resulting short-lived boost in the company's share price. Investors who'd bought shares on the basis of that boost felt aggrieved, as did older shareholders who complained that the value of their investments had been impacted, and class-action law-suits flurried like leaves in autumn. Suffice to say that the management change has not stilled those murmurs and speculations about the prominence of sharp practices, and misleading investment-encouraging press releases, in the MNGA / TNRX business model. But I am bored with all this now, and the readers are bored.

So we move quickly along to Infinite Fuels GmbH, founded in Berlin in 2014 by Andreas Noky and Matthias Müller (not the VW dude, but his namesake). It subsequently relocated to Schleswig-Holstein in North Germany... or rather in South Jutland, for as a Danish irrevanchist I am compelled to wave the Sydslesvig flag. Its website is vaporous and detail-deprived when you look past the verbiage and imagery signifying green aspirations. The most content to be found on the website is a press-release from Jan 2020, boasting that practical implementation of IF plans will be outsourced to Concord Blue, a company with some experience.

This is the commercial entity now in receipt of €6 mill from the European Commission's LIFE program (Executive Agency for Small and Medium-sized Enterprises, EASME) to build a biomass-reclaiming syngas plant (the source of the other €6 mill in the budget is unclear). A "Success Story" background profile attached to an EU press-release alludes to "Engineer Andreas Noky and business economist (MBA) Matthias Müller". Apart from founding and mothballing more companies with similar descriptions -- Synthec Fuels in Müller's case, Hydrogen Energy in Noky's -- neither founder has any obvious background in the synthetic-fuel biomass-recycling industry; they seem to a casual glance to be members of the consultancy class.4

To be fair, in another role as Talon Ventures & Consulting GmbH, Müller purchased a gasifier from MagneGas and licensed their technology in 2016... though in 2017 he fell behind with payments on the gas-cylinders and regulators and incurred an Extension Fee.5 However, Müller has left the company. Even so, his Synthec website holds a copy of that IF / Concord Blue press-release. Is it a back-up or Plan B?

The water is further

Initially Taronis press releases featured Taner Ay -- industrial entrepreneur and son of Turkey's leading construction magnate -- as instigator of that deal which would make MagneGas the industry standard across the Turkish engineering sector (as may well be possible in a centralised autocracy where the key to economic dominance is to have the ear of someone near the top). Taner Ay soon dropped out of the picture, though, and there is no evidence that he was ever anything more than a social-media personality residing in Germany, a stunt-sockpuppet hired for the purpose. Taronis press releases pivoted effortlessly to feature a replacement Turkish "company with deep, deep pockets backed by people with billions of dollars and resources". The statements claimed that the contract was worth $20 mill and received the highest level of Turkish official backing, with positive implications for TRNF's value as an investment.

I have no information from Turkish sources that would falsify those press releases (and no idea where to go looking for it), and it is no skin off my nose if they're all true. One notes, though, that the installation of MagneGas reactors on Turkish soil keeps slipping to new schedules, while the transfer of moneys into Taronis accounts is equally dilatory, following the general pattern of delays in payments for intellectual property. I can understand why observers like 'Purple Penguin' view the whole process as sleight-of-hand and legerdemain to create an illusion of a healthy financial future, shuffling money among sockpuppets and shell companies so that the velocity and volume of circulation makes up for the lack of money entering the system from outside.

Müller, Ay, Mahoney

Before sinking back into the virtual-particle flux of the quantum vacuum, Taner Ay mentioned Taronis and IF in his statements, regarding them as two buttocks of a single bum. Conversely, Müller was consulted for a press release targeting the Turkish audience, and credited Taner Ay with introducing him to MagneGas technology [warning: Google Translate does not play well with Turkish syntax]. All three know each other.Financially, we see the $1,000,000 consulting fee to be earned by MagneGas to provide technical, research and operational expertise from our existing research and development team as a powerful way to offset startup costs related to our European market expansionMeanwhile, press releases from the Taronis end claimed that $1 million of that EU grant to IF will flow straight into Taronis coffers as a consultancy fee6, though this could be another example of creative phrasing to assuage concerns about the company's finances. It further appeared (at least from the Taronis perspective) that the German gasifer is an IF / MagneGas joint venture; and that IF is a subsidiary of Taronis, or (as of Feb 2018, still with the younger Santilli as helmsman) is committed to becoming a subsidiary. The deal was presented to shareholders as a bridgehead to opening the European syngas market, which is expected to be lucrative in the way that the US market isn't.

TAMPA, FL--(Marketwired - February 06, 2018) - MagneGas Corporation ("MagneGas" or the "Company") (NASDAQ: MNGA), a leading clean technology company in the renewable resources and environmental solutions industries, announced the execution of a Letter of Intent to form an Ireland-based holding company for the express purpose of acquiring 100% of Infinite Fuels, GmbH, an emerging biofuels company based in northern Germany. MagneGas will initially own a 40% stake in the joint venture, with the possibility of increasing the Company's equity stake to 70%. The remaining equity stake will be owned by the current principals of Infinite Fuels. Following formation of the joint venture, the new entity will assume 100% ownership of Infinite Fuels. The initial transaction is expected to be funded through a combination of cash on hand and equity in the new joint venture.Due to accidents of residence, I do not have to worry that the LIFE program might have funnelled millions of development euros into a company from the US that developed its inefficient, out-of-date syngas technology by trying make sense of Santilli's Magnecular fiddle-faddle. I can safely pretend that the whole story is the outline of a Carl Hiassen novel or the script of a Soderbergh movie, sent back for revision to make the characters more plausible. Were I located in the EU, though, I would be reading that Enterprise Europe Network press-release with some concern: while the authors congratulate various EU agencies with helping IF to get their proposal together, they show no awareness that Talonis are also claiming credit (and $1 million in fees) for that same accomplishment. I would be wondering whether LIFE knew the full background of the deal when they stumped up with €6 mill when the ultimate ownership is so unclear.

It may be that I have misunderstood a source while writing this post, or placed credence in a source that was not fully reliable. I am sure that our host will correct any errors of fact in this post if he is contacted and provided with evidence.

“Santilli continued, “The grant writing process was extremely well managed by our advisors at Ernst & Young, and is encouraging as we seek out similar non-dilutive grant opportunities for our sterilization technology in Europe. Lastly, this project is expected to provide a steady source of scalable revenues to MagneGas as we expand our relationship with Infinite Fuels in Germany.”

* * * * * * * * * *

1. "Editor-in-Chief of IJHE" is evidently a hereditary role.2. Santilli-Galilei Medals were in fact a thing in 2007, named after Italy's two greatest scientists and awarded by the Santilli-Galilei Academy of Sciences as an excuse for everyone to dress up in Renaissance Tuscan garb like the subjects of Piero della Francesca portraits. In 2008 the names changed to Telesio-Galilei Academy / medals, however, after a falling-out in the working relationship between Santilli and Francesco Fucilla. Note that Fucilla also collaborated with Mignani and Cardone on the 'piezonuclear' route to transmutation, thus creating links between two of the Cold Fusion enthusiasts covered elsewhere. That subplot, though entertaining, is peripheral to our current concerns.

3. In 2017 they moved on to using corn-sourced butanol - the product of a backdoor Bush-era subsidy for agribusiness in flyover states. In other words the greenwashing aspect of MagneGas comes with a huge carbon footprint.

4.

Matthias Mueller started his career working in international business development for BAA, British Airport Authority. From 1994 to 2005 he owned a business advising investors on real estate acquisitions world wide focusing on environmentally responsible developed real estate. The passionate private pilot changed his career path in 2005 and joined a business jet manufacturer in Montreal, Canada, which he headed until 2011. Being focused on sustainability the company divison developed a business jet, that was 90% recycable with the lowest fuel consumption in its class. From 2011 – 2014 Matthias worked as strategic adviser for various renewable energy companies. In 2014, Matthias co-founded Infinite Fuels. Matthias has senior experience in strategic planning, business development, risk and crisis management, project management, controlling and cash management; he introduced change, restructured and relocated business operations, developed and executed business growth and improvement strategies. Matthias holds a Master of Business Administration from Ashridge Business School.

5. Santilli fils transfered that contract to a subsidiary company in late 2017, and it's anyone's guess who holds it now.

6. "Financially, we see the $1,000,000 consulting fee to be earned by MagneGas to provide technical, research and operational expertise from our existing research and development team as a powerful way to offset startup costs related to our European market expansion."

UPDATE #1: In the interests of brevity I skipped over two other Santilli accomplishments, both documented at Thunder Energies Corporation before the company changed ownership and the website shifted to marketing hemp products. Both involved Directed Neutron Source technology, applied to the detection of (a) concealed nuclear bombs, and (b) promising seams of gold ore, in mining ventures.

http://www.globenewswire.com/news-release/2017/06/05/1008093/0/en/Thunder-Energies-Receives-Down-Payment-on-Equipment-Producing-a-Directional-Neutron-Flux-and-Predicts-Profitability-for-its-Construction.html

https://www.globenewswire.com/news-release/2019/03/21/1758528/0/en/Thunder-Energies-Corporation-TNRG-Announces-the-Upgrade-of-a-Letter-of-Intent-to-Test-the-Detection-of-Precious-Metals-in-Mining-Operations.html

The neutrons come from hydrogen atoms, with ‘neutroids’ as an intermediate step, by intermeshing the cog-teeth of each proton with its corresponding electron. An electric arc – as central to Santilli engineering practice as leeches were to medieval medicine – is involved. This in turn is possible because of Santilli isorelativistic isomathematics, where numbers can take on whatever values are needed to provide solutions that are impossible according to mainstream maths.

Confirm-neutron-Final.pdf

One reason for Santilli’s lawsuit against Pepijn van Erp was to defend his DNS products from disparagement. Causing widespread bewilderment, as Pepijn hadn’t even mentioned the topic.

UPDATE #2:

Italy may be the land of eternal Nobel Prize candidates, all elderly males with swollen egos

Ah. An out-take, exploring a side-story…

Santilli’s first venture at monetarising his magnecular-bond technology was in the late 1990s, through a company ‘Earthfirst NextGas” and its subsidiary USMagneGas, where the name emphasised the Green ecological aspects.

"A Largo company with a former Harvard University physicist has created a process to convert liquids such as anti-freeze and sewage into a gas that operates automobiles."

That deal went spectacularly tits-up amid allegations of defamation and theft of intellectual property, and the lawsuits were still going on in 2007. 2007 was when Santilli and Bo Linton were inspired to co-found MagneGas.

https://www.sec.gov/Archives/edgar/data/1353487/000121390007000350/f8k0307_magnegas.htm

Now records reveal that Mr Linton is unfortunate in his choices of businesses to direct, at least from the perspective of investors, for his business acumen is seldom reflected in rising share prices. Linton may just be a bird of ill-omen, and I don’t want to confound correlation and causation. That anonymous “Pump Stopper” author went into more details than anyone really desires.

https://www.valuewalk.com/2015/12/magnegas-mnga/

I mention this because of a few links and parallelisms, together illustrating the smallness of the world. In the context of the Santilli-Galilei Academy, I mentioned Santilli’s one-time associate Francisco Fucilla — a veritable philosopher-king, whose family occupy a rarefied, speculative milieu of high-risk mining ventures, sharemarket advice, and movie projects. To pursue the background at greater length would be to poach from Sylvie Coyaud’s Park of Buffalos, so instead I’ll refer the reader to people who’ve had dealings with the clan or have been stalked by them.

https://www.sott.net/article/251809-Francesco-Fucilla-Impossible-science-doesnt-exist

https://www.sott.net/article/244011-Corruption-in-Science-Francesco-Fucilla-and-the-Telesio-Galilei-Academy-of-Science

https://cassiopaea.org/forum/threads/telesio-galilei-academy-of-science-a-fraud.27261/page-20

Suffice to say that the business interests of House Fucilla are far-flung and enlivening, and their antics are the stuff of novels, if Carl Hiassen could be persuaded to shift his usual literary locale from Florida to London. Specifically, to Croydon, site of the warehouse containing Fucilla’s “SteriWave Startec” company. Did I mention that Fucilla has his own effluent-detoxifying-plasma and pocket-fusion invention(s)? They seem to be as Italian as pizza ovens.

Now the original founders of this parallel SteriWave company included Albert Reda, a colourful individual whose unconventional conduct as a company director later led to him enjoying US federal hospitality.

What concerns us here, though, is the discovery that Reda and Bo Linton also know each other — as directors of another company from that Florida renewable-energy milieu, GDT TEK (Green Day Technologies). This was either a subsidiary of SteriWave or a joint venture, with a license to distribute Fucilla’s pocket-fusion / effluent-sterilising technology.

http://getfilings.com/sec-filings/120126/SEAMLESS-Corp_8-K/

There was even a prototype of the “Piezonuclear Ultrasonic Cascade Reactor”!

https://web.archive.org/web/20140130035217/http://www.gdttek.com/press-03-06-12.php

And thus the circle closes, with everyone associated with everyone else. In fact Albert Reda is a redundant link, and I mention him mainly for the sake of his fraud conviction and 26-month sentence, as Bo Linton was also directly linked to House Fucilla, through their joint directorships of the recently-defunct company Steriwave-GDT-TEK.

UPDATE #3

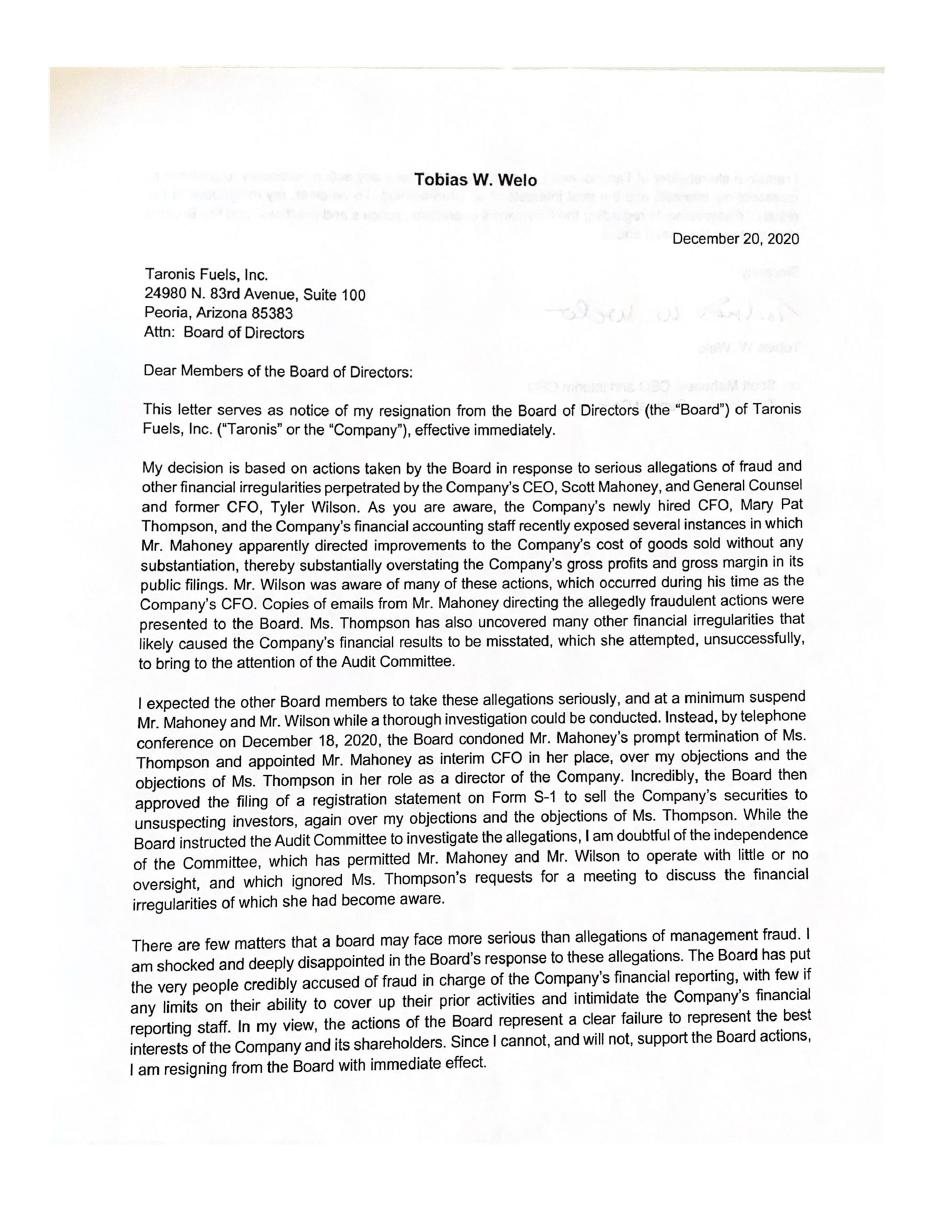

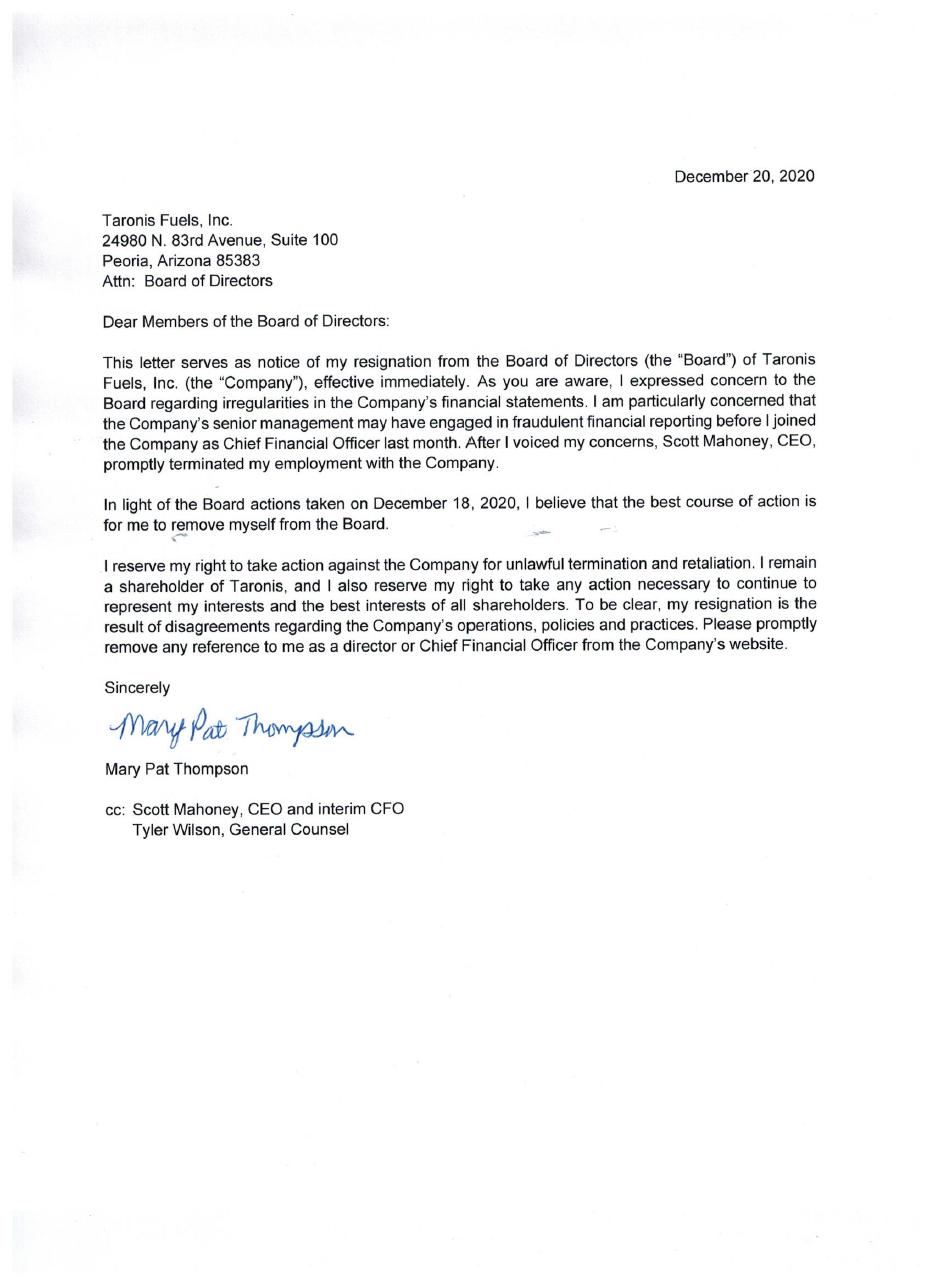

Taronis removed two senior executives, as per press release from 21.12.2020:

Taronis Fuels, Inc., (“Taronis” or “the Company”) (OTCQB: TRNF), a global producer of renewable and socially responsible fuel products, today announced that on the morning of December 18, 2020 Mary Pat Thompson, the Chief Financial Officer of the Company, was suspended indefinitely pending the resolution of a now ongoing investigation into multiple alleged violations of her duties and obligations as an officer and director of the Company. In addition, Tobias Welo, an Independent Director, was provided written notice by the Company of concerns regarding potential breaches of his fiduciary duties.Now guess what happened (source here and here):

CEO Scott Mahoney and General Council/former CFO Tyler Wilson are accused of fraud, including of defrauding investors! The whistleblowers announce lawsuits against Taronis and make their fraud accusations public! Merry Christmas to the Santillis, Taronis and of course also to Infinite Fuels!

No comments:

Post a Comment